Make-in-India Green Energy Innovation

We engineer end-to-end energy and e-mobility systems — from power electronics and embedded firmware to digital platforms and supply-chain localisation. Built in India, for India, and for the world.

Trusted by Leading Organizations

Complete Charging Infrastructure Platform

Everything you need to deploy, manage, and scale your EV charging network

State-of-the-Art Hardware

Durable, high-performance charging stations engineered for commercial and residential deployments with fast, reliable charging speeds.

OCPP/OCPI Compliant

Open, vendor-agnostic platform with full OCPP 2.0.1 and OCPI 2.2.1 compliance for seamless integration and multi-network roaming.

Real-Time Analytics

Advanced monitoring and analytics for optimized energy usage, system performance, and data-driven decision making.

Enterprise Security

Bank-grade security protocols, encrypted transactions, and comprehensive compliance with industry standards.

Mobile App & Dashboard

Intuitive mobile app for drivers and comprehensive web dashboard for hosts to manage chargers and track performance.

Smart Locator

Find available chargers across the entire Joulepoint network with real-time availability and navigation support.

Track Your Progress at Your Fingertips

Monitor charging sessions, track savings, and locate chargers across the Joulepoint network. Complete transaction history and real-time updates.

Track Distance & Savings

Monitor your EV journey and environmental impact

Session Management

View consolidated transaction history and active sessions

Network Locator

Find available chargers with real-time status updates

Explore Our Software

Enterprise tools to operate, optimize, and scale EV charging networks.

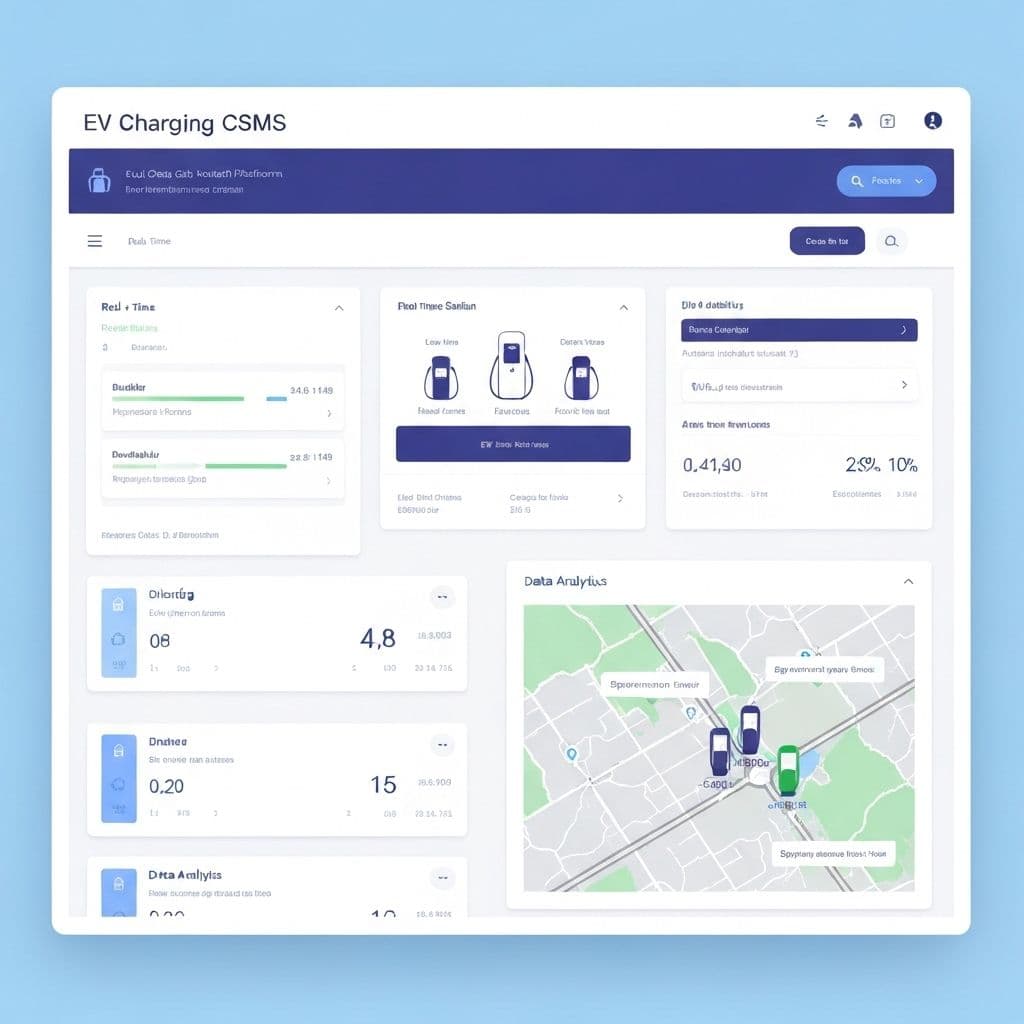

OCPP/OCPI CSMS

Enterprise-grade network management, smart load, roaming, and remote diagnostics.

Fleet Management

Plan charging, monitor vehicles, and minimize downtime for commercial fleets.

Energy Intelligence

Optimize energy usage and costs with advanced analytics and orchestration.

OEM Remote Diagnostics

Proactive monitoring and field service tooling for charger OEMs and integrators.

Explore Our Hardware

From AC/DC chargers to power electronics and vehicle systems—engineered for scale.

EV Chargers

High-performance AC/DC chargers for public and private sites.

Onboard Chargers

Automotive-grade onboard charging systems.

Smart Meters

Revenue-grade measurement and billing integration.

DC Controller & PLC

High-reliability control modules for DC fast charging.

DC-DC Converters

Efficient power conversion across EV subsystems.

Solar Inverters

PV integration for energy optimization and resilience.

Traction Inverter

Automotive traction systems for EV propulsion.

VCU / ECU

Vehicle and engine control units for OEM platforms.

OBD Remote Diagnostics

Remote fault detection and telemetry via OBD.

CPO Solutions

End-to-end turnkey charging infrastructure for businesses, municipalities, fleets, and property owners.

Explore CPO SolutionsOCPP/OCPI Platform

Enterprise-grade network management platform with smart load balancing and remote diagnostics.

Explore PlatformReady to Build Your Charging Network?

Schedule a personalized demo to see how our solution can address your specific needs.